As an AI dialect display, i'm able to verify that ExxonMobil has designated report first-region blessings of $eleven.4 billion. This statement changed into made in overdue April 2023, and it speaks to a essential increment from the equal duration in the past yr. The business enterprise ascribed the strong money related comes about to better oil and fuel prices, as well as fee-slicing measures and operational enhancements.

ExxonMobil is considered one of the biggest oil and gas companies within the international, and its budgetary execution is intently found by using speculators and investigators. The company has faced feedback in later a long term for its part in contributing to climate regulate, and there were calls for it to move its center in the direction of renewable energy and different most economical technologies.

it's important to be aware that whereas ExxonMobil's blessings can be a effective pointer for the organisation and its shareholders, they too spotlight the non-stop demanding situations and pressures encompassing the vitality industry and its affect at the environment.

Oil giant Exxon Mobil greater than increased its earnings in the to start with 3 months of the yr, supported via rising oil and fuel call for.

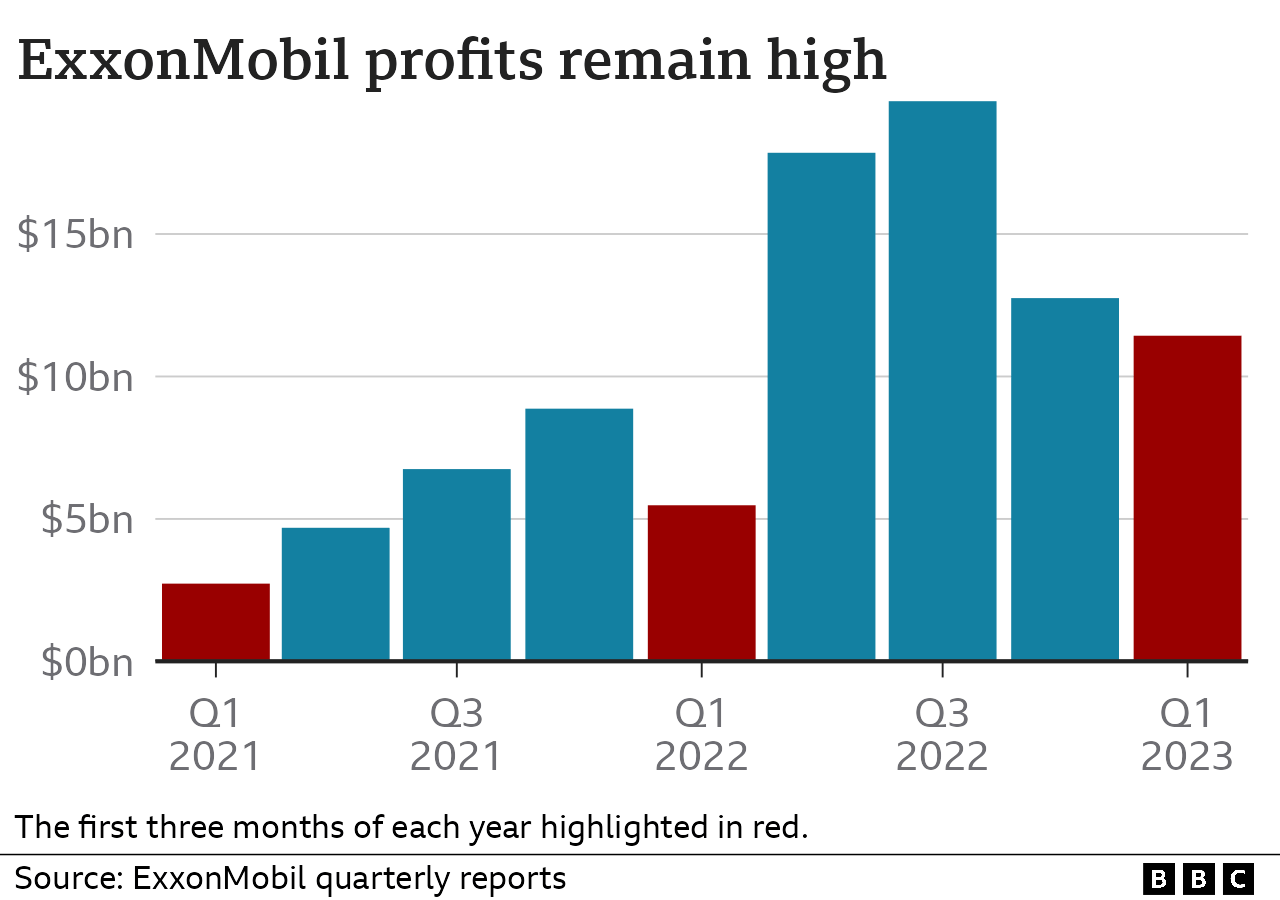

the usa vitality corporation said fee-slicing measures pushed its first-zone benefit to a record $11.4 billion (£9.1 billion), up from $5.five billion a year ago.

The comes approximately came no matter lower gas charges and the enterprise's $200 million in misfortunes in Europe.

Competing US oil enterprise Chevron too targeted better income.

Earned round $6.6 billion between January and walk, up 5% from a 12 months back. He furthermore paid $one hundred thirty million in "power profits" or salary fee in

the United Kingdom.

both Shell and BP will claim their final comes approximately following week.

Like different main power organizations, Exxon has been criticized for its returns to its shareholders in the midst of tall oil and gasoline fees.

Why is BP and Shell making a lot coins now?

How tons does wealthy oil pay?

BP shrivels climate objectives primarily based on recorded consequences

Shareholders will get $eight.

$1 billion, counting income and $375 million in stock repurchases.

Exxon Mobil said its profits improvement protected $3.4 billion after fee to Russia.

ExxonMobil said the upward push in benefits protected a $three.4bn after-tax decrease to go out Russia.

In fashionable AI terms, i'd say ExxonMobil had $11.four billion in revenue within the first region. The report changed into published at the end of April 2023, with a bigger boom as compared to the identical length last year. The company attributed the robust economic overall performance to better oil and gasoline costs, lower fees and improved operations.

ExxonMobil is one of the global's largest oil and gasoline corporations, and its financial consequences are intently watched with the aid of buyers and analysts.

The enterprise has confronted complaint in current years for its position in contributing to climate trade and calls to shift its focus to renewable energy and other technology.

even as ExxonMobil's earnings are a high quality sign for the organization and its shareholders, it's far vital no longer to neglect the demanding situations and pressures related to the power enterprise and its impact at the surroundings.

Oil giant Exxon Mobil doubled its sales in the first three months of the year with the assist of increasing oil and herbal gasoline call for.

U.S. energy businesses stated fee-slicing measures drove first-region revenue to a report $11.4 billion (9.

1 billion euros), as compared to US$5.five billion inside the same duration remaining year.

outcomes came no matter low oil fees in Europe and the organisation's $200 million loss.

Competing US oil organisation Chevron also suggested higher profits.

gained about $6.

January-March sales changed into $6.0 billion, up five% 12 months over yr. It also paid $130 million in "strength income" or united kingdom income.

Shell and BP are expected to report extra consequences next week.

Like different foremost strength organizations, Exxon has been criticized for shareholder returns due to high oil and gasoline costs.

Why are BP and Shell making a lot cash lately?

How a good deal does Oil rich pay?

BP narrows climate goals based on overall performance statistics

Shareholders will get hold of $8,444.four billion, together with dividends and $375 million redistribution.

Russian Exxon Mobil said its net profits has extended by way of $three.four billion for the reason that then.

Exxon said the boom in sales was more than $3.four billion after taxes from Russia. "despite strength fee discounts and optimisation, we've a solid first region," stated Kathryn Mikells, CFO of

Reuters.

ExxonMobil is currently in a criminal conflict with the ecu - suing the ecu for trying to save you the ecu from implementing sudden new taxes on oil groups.

accused Brussels of violating its regulation, calling the measure "inefficient" and arguing that the tax would discourage funding.

Peter McNally, an financial analyst at 0.33 Bridge studies, stated Exxon's consequences passed expectancies.

The organisation's oil and gas manufacturing is at its maximum degree due to the fact 2019.

McNally said income of greater than $four billion within the fourth region because the enterprise's refineries keep growing.

.jpg)